GameStop stock was set to skyrocket in May.

This time, I wasn’t just going to watch. I wanted a piece of the action.

Back in early 2021, when GameStop became a meme stock that shook up the financial industry, altering lives for richer and for poorer, I still wasn’t into the stock market. I remember reading headlines and watching news segments about the event. But I didn’t comprehend what was happening — or how much money was changing hands.

Earlier this year, me and my lady friend, Triest, watched the movie “Dumb Money,” which chronicles the infamous GameStop rally. The movie is far more entertainment than education, but it added a little more context.

A few weeks later, the man responsible for transferring millions of dollars into the hands of regular “retail investors” like you and me resurfaced. His name is Keith Gill. You may know him by his alias: Roaring Kitty.

After three years of silence, Gill recaptured the world’s attention with a single tweet, a meme (pictured above) of all things. A sketch of a man leaning forward in a chair while holding a video game controller sent GameStop’s stock soaring more than 60%.

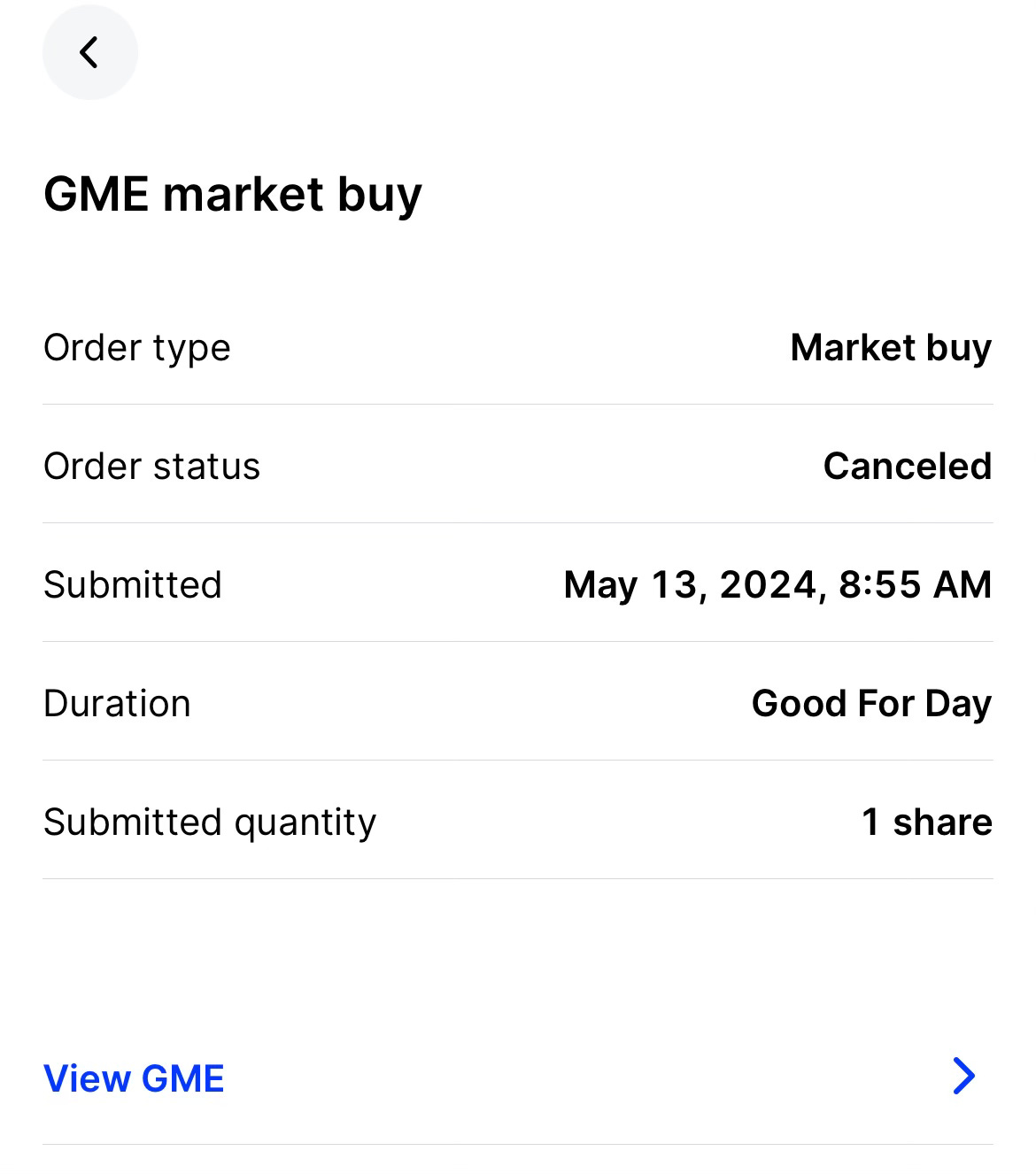

Gill posted his tweet on the evening of May 12. GameStop’s stock went parabolic in the pre-market on May 13.

Gill never mentioned GameStop.

I watched the whole thing unfold in real time. That Sunday night, I couldn’t wait for the market to open Monday morning. My curiosity quickly morphed into FOMO, or a fear of missing out.

Less than 30 minutes into the open, I couldn’t resist. I bought one share of GameStop stock. Its price ticked higher and higher, and I felt like a fool sitting there watching. I refused to let the stock price take off without me.

My decision was tantamount to playing the lottery.

I had no business buying GameStop stock, yet I punched in my order being fully aware that I was gambling. That’s why I got cold feet and backed out one minute later.

My confirmation email shows I placed my order at 8:55 a.m., with GameStop’s stock price at $33.29. But the stock halted several times that morning, and my order didn’t get filled immediately. That meant I no longer had control over my purchase price. Instead of $33 — already overvalued — my one share might have cost $40.

I canceled my order.

I sent a text to my brother Clifton at 9:04 a.m. showing and explaining my reasoning.

“I put in an order for one share, got cold feet and realized it goes against everything I’ve learned about investing,” I wrote. “So I backed out…But it’s going to be fun to watch!”

That same day, GameStop stock ran up to the $65 range. That night, me and Cliff texted about “puts,” an option contract that anticipates a stock price will fall.

“I looked at puts too,” I wrote. “I’m not touching that joint in any way.”

It took almost two years for me to build my restraint in the stock market. I’ve had to learn that every stock I see isn’t a good investment for me.

Nvidia’s yearlong rally is another example. It would have been easy for me to throw (dumb) money at that darling stock. But I don’t need to chase every hot stock. I’m a believer in a simple path to wealth.

Fortunately, I adopted that philosophy before losing big on any equities.

My worst two positions are in stocks I chased, with no understanding of what I was investing in. Being deep in the red is more painful than missing additional profitis.

So never be in fear of missing out. And that goes beyond the stock market, Parker.

There will be many things competing for your attention along your journey: toys, games, television, movies, music, friends, food, parties, vacations, shopping, sleep and so on.

Don’t let any of it distract you.

The only things worth chasing are your dreams.

REALLY nice column, Darnell .... REALLY nice ...

Restraint is a crucial element of investing success ... learning it is tough ... KEEPING it is even tougher.

Restraint is like a muscle ... use it or lose it.

We did a piece about GameStop a bit ago ...

Sharing it here ... just FYI ...

Nice work .... keep it up!

Bill Patalon III

https://open.substack.com/pub/stockpickerscorner/p/we-predicted-it-the-gamestop-time?r=3ftiph&utm_campaign=post&utm_medium=web

Thank you for explaining FOMO to Parker and to me! Great principles for money and life!