I’ve made more money over the past 26 days from a single stock trade than I’ve generated by amassing shares of the same company for almost two years.

Of course now I can’t unsee the gains that I’ve seen.

But seeing a supersized percentage — I’m talking triple digits — in such a short amount of time is a gift and a curse.

Because in the same week that I celebrated my two-year investing anniversary, I also ran into the harsh reality that I’ve been going about growing our money all wrong.

In financial terms, that means I haven’t maximized our returns.

I’ve dedicated significant time and capital to stock market investing over the past two years. And I’ve learned to multiply our money.

But I could have done so faster and required far less invested capital had I focused on a more profitable method sooner.

That method is options trading.

I told you the story of my introduction to options trading last November. Back then, I was happy to net a $4.68 gain. It was my first profitable options trade. Today, the unrealized gains in my options account are nearing four figures.

What’s crazy is I’ve placed only nine options trades, including three that remain in play. I’m still a novice. I’m not ashamed to admit that I still don’t know entirely what I’m doing.

But I’ve learned enough to adopt a successful strategy. It’s based on pinpointing a basic pattern — one that has the potential to turn a profit at a significantly greater rate than I have through the traditional buy-and-hold strategy.

And green days have grown my confidence along with my account.

Of all companies, Chesapeake Energy (CHK) is the one that showed me the power of options. It’s the same company’s stock I chose when I tiptoed into the stock market 16 years ago. It’s also the stock I’ve held shares of in my taxable account since November 2022.

That makes Chesapeake Energy (which will soon merge with Southwestern Energy to become Expand Energy) the best example of why options trading has captured my full attention.

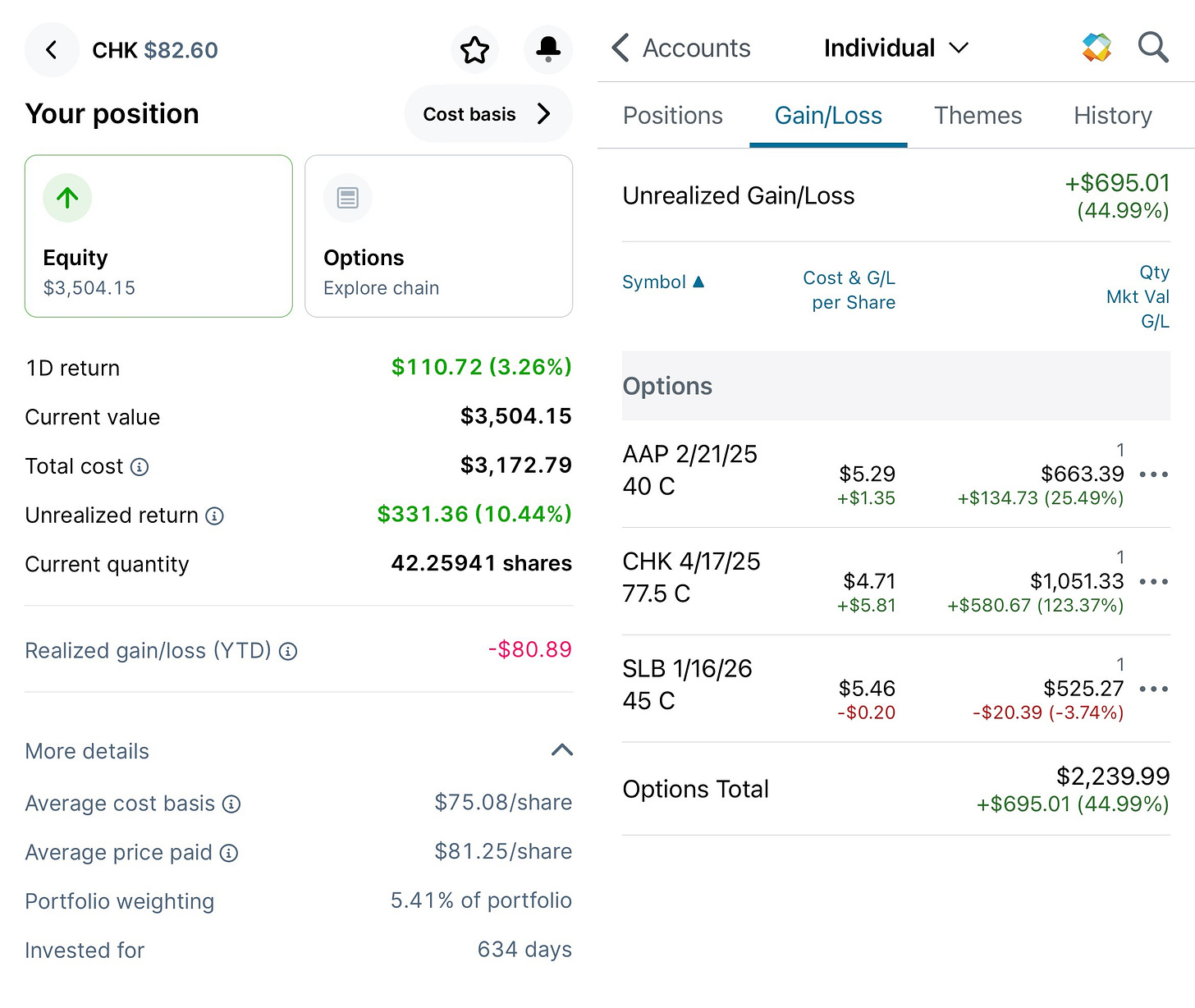

I own 42.25941 shares of Chesapeake common stock. My total cost is $3,172.79. I’m currently up 10.44%, or $331.36. My stake has fluctuated, but I’ve held a position in the company for 636 days.

Compare that with the options trade I placed on Chesapeake.

I placed my order, a call option, on Sept. 3. For one contract, or the right to buy 100 shares at a specified price before the contract’s expiration, I paid $470.66. That contract is now worth $1,051.33, an unrealized gain of $580.67 or 123.37%.

My Chesapeake option doesn’t expire until April. The value of my option increases exponentially each day the company’s stock price ticks higher.

The highest unrealized return I’ve seen my Chesapeake option reach is 142.21%, a $669.34 potential profit.

Honestly, I don’t know when to sell. I never considered needing to learn that step of the strategy this fast.

Seeing our money rapidly rise in real time, however, is reminiscent of the realization I had at the start of my investing journey that the banks were getting over on us. Chesapeake gains in my buy-and-hold account feel akin to the pennies in interest I settled for from banks for far too long.

I almost feel foolish.

But I know that every minute I spent learning the market over the past two years prepared me for the advanced level I’m stepping up to. Without that time, reading, researching, listening, learning and losing, I wouldn’t be equipped mentally or emotionally to handle higher risk.

The educational component is a must. But it’s not difficult.

I’m in the process of introducing Parker to options trading. She’s still 2 ½ months shy of her 11th birthday. And she’s more than capable of reading stock charts and pinpointing patterns. It will accelerate her wealth-building journey.

Meanwhile, I must be careful.

I already was in consolidation mode. Now I’m fighting the urge to jump on every trade I identify as a potential winner. Patience is a vital part of the risk management required to play this game. I’m also taking it slow while I learn to analyze companies and evaluate their balance sheets. My aim is to limit my exposure in options primarily to quality companies.

But I entered into two more trades last week, my eighth and ninth attempts. I placed a $45 call option on Schlumberger last Monday. Two days later, I entered a $40 call on Advance Auto Parts.

I concocted the strike price ($45) and expiration date (Jan. 16, 2026) on Schlumberger (SLB), but I took the tip from a successful influencer. I did my own research and felt comfortable with entering a trade.

I’m more proud of my Advance Auto Parts (AAP) play. Like Chesapeake, I identified it on my own. After three trading days, my AAP option is up $134.73 or 25.49%. It doesn’t expire until late February, which means it also has plenty of room to run.

I still believe in the buy-and-hold method. It’s a proven strategy for embarking on a simple path to wealth.

But I can’t unsee what else I’ve seen along the journey.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

You are goals Darnell! I’ve fallen victim to the comfort my dividend and long term stocks bring. The few times I tried my hand at options, it was a flop lol. I’ve subscribed to join your journey in hopes of making it further along mine.