My eyes were glued to my phone Friday.

It was the monumental day I assumed was another three years away.

Every few seconds, from the morning until the early afternoon, I refreshed the brokerage app that houses my Roth IRA.

My money was moving in the right direction.

The money that I mistakenly left untouched for nearly five years is doing better than I ever dreamed it would.

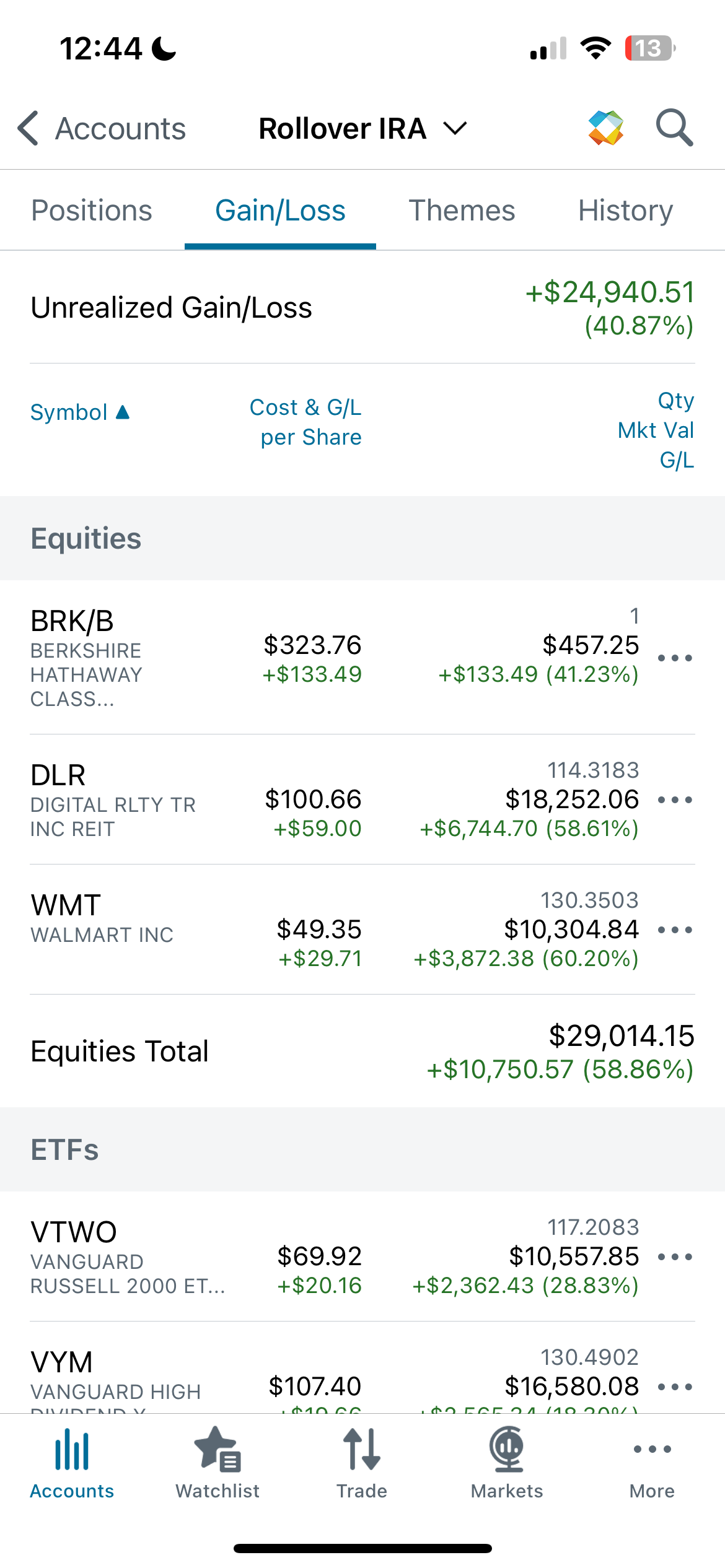

My account almost touched $25,000 in unrealized gains for the first time.

I’ve had the account open for only 21 months.

When I told you about my biggest investing blunder last September, I incorrectly figured that my inaction over a nearly five-year period was a $25,000 mistake.

Friday revealed how far off I was.

It also was another undeniable example of why it’s imperative to put as much of your money to work in the stock market as soon as you can.

I’ve conceded that I was lucky when I got serious about investing. I stumbled into stocks at the bottom of a brutal year in the market. The bull run that began in earnest at the end of 2022 has been my only point of reference. It has buoyed all my portfolios.

A bear market inevitably will come. Unrealized gains that appear gorgeous now will plummet, perhaps even turn red.

I won’t panic. I’ll buy more. It’ll make the gains look even better when the market rises again.

For now, I’m enjoying the ride up.

The money I foolishly allowed to sit under my nightstand, $45,959 to be exact, has turned into $85,727.19 — a 40.47% gain.

As of Friday’s close, my unrealized gain showed $24,698.87. At one point early that afternoon, my account sat less than $50 from touching $25K.

I’m hoping this week will be the week.

I’ve added only $15,073.15.

I’ve collected another $2,257.38 in dividends from my Roth IRA. All of my dividends are reinvested back into the equities that paid them.

Walmart is my best performer, currently showing a 60% unrealized gain. I initially put $4,542 into the company’s stock. I added another $1,750.50 between January 2023 and April of this year, plus $139.96 in reinvested dividends for a cost basis of $6,432.46.

The market value of my 130 Walmart shares is $10,305.49, or a $3,873.03 unrealized gain.

Digital Realty Trust is my second best performer at 57.66%. I bought low on this REIT (real estate investment trust) that operates in data centers. I’ve been pleased ever since, while spooked at the same time that it’ll plummet.

I put twice the capital into Digital Realty Trust as I did into Walmart, though. My position shows a $6,634.95 unrealized gain.

My biggest unrealized gain but third best performer percentage-wise can be found where I parked most of my money: The Vanguard Total Stock Market Index Fund. It shows a 44.7% gain but $9,188.34 in unrealized profit.

The Vanguard Russell 2000 ETF is fourth at 28.23%, or $2,313.48 in unrealized profit. And the Vanguard High Dividend Yield ETF is fifth at 18.25%, good for $2,557.52 in unrealized gains.

I added one share of Berkshire Hathaway’s B class shares back in May 2023. Warren Buffet’s company is one of the best performing stocks in history. I’m riding it up. My lone share is up $131.55, or 40.63%.

I started this account only three months into my stock market journey. I didn’t know enough then to pick stocks so successfully, and I still don’t.

The biggest key is that I haven’t sold a thing. I’ve let my positions cook.

But that’s about to change.

My original plan was to diversify, and I’ll maintain that approach. But much like my taxable account, there’s overlap I must address. Here’s why.

The Vanguard Total Stock Market Index Fund, which covers my investment needs just fine by itself, has yielded 44.7%. Meanwhile, my two smaller ETFs, the Vanguard Russell 2000 ETF, and the Vanguard High Dividend Yield ETF, are significantly less profitable at 28.23% and 18.25%, respectively.

My idea is to consolidate within my Roth IRA just like I’ve done in my taxable account.

I’ll take profits from the two ETFs, and likely a portion from Digital Realty Trust, and redistribute them into the Vanguard Total Stock Market Index Fund, ticker symbol VTSAX.

I’m actually searching for safety more than greater returns. But the glaring differentials in my profits made my original oversight plain to see.

I’m learning to play this money game.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

Great win! Love your idea of simplifying further of course. One thing I've noticed about your portfolio you've mentioned, no international stocks. This is a highly contentious issue and there's no right answer, but I generally adhere to what most academics say, which is that you should have somewhere between 20-40% of your equity allocation international based. This is what almost all target date funds adhere to, and I trust the thousands of experts on that front. All our portfolio is either in a TDF or Vanguards Total Word ETF VT, that buys the market cap as it stands across all countries.

International diversification also makes intuitive sense to me. I live in the US, spend US dollars, work in the US, and my social security is dependent on the US. Even if I have 40% of my stocks international, I am still heavily dependent on the US, so diversifying internationally seems like a reasonable small hedge.

Over the course of history, whether you'd be better of with international stocks or only US stocks has flip flopped. For the past 15 years or so it's been better to be all US, but I've got many years of investing ahead and am not comfortable putting all my eggs in one basket.