The idea of this column is to illustrate the importance of buying and holding.

To do so, I’m showing you my screw-ups.

I made many mistakes as a newbie stock market investor. I couldn’t help but to quickly learn the perils of selling a stock prematurely.

Anytime I need a reminder, I can just thumb through my brokerage account’s transaction history or search for a company’s name in my inbox. I still have virtually every confirmation email. They help me track my entries and exits and compare them to where a stock’s price is at present.

The only thing I can’t stand more than selling for a loss is looking back and seeing a stock price has soared after I sold.

Sadly, I have more than a dozen such examples. If I listed them all, this column would stretch into next week.

But my ample blunders from when I didn’t know any better helped to build my buy-and-hold tolerance. Now, it’s not hard at all for me to have a long-term investment horizon. Not even forever feels very long.

Consolidation is my only saving grace for several of my early exits.

I folded much of the money from multiple positions into my chosen total stock market index fund. That helped me to salvage the majority of the appreciation I would have lost from selling individual stocks.

It eased the pain of parting with a skyrocketing stock.

But I still wonder what if?

Here are my 10 biggest regrets.

Meta: I owned nine shares of the parent company for Facebook, Instagram and WhatsApp. I bought them when the company and its co-founder, Mark Zuckerberg, was taking a public beating in late 2022. I was less than two months into stock investing. Against my better judgment, I bet on earnings. A $25 gamble turned into a $906.04 commitment over the course of six trading days.

Meta’s earnings missed. Its stock price plummeted. My $25 Hail Mary on Oct. 26, two minutes before the close, came with the stock price at $129.53. The next morning, the stock price was $100.22. I purchased another $25. But the stock kept sinking. And I kept panicking, buying more to lower my average purchase price. I bought another $400 worth of Meta stock that same day, with the price just above $100.

I bought two more shares on Halloween at $95.15 a share. Three days later, I purchased three more shares at $88.58.

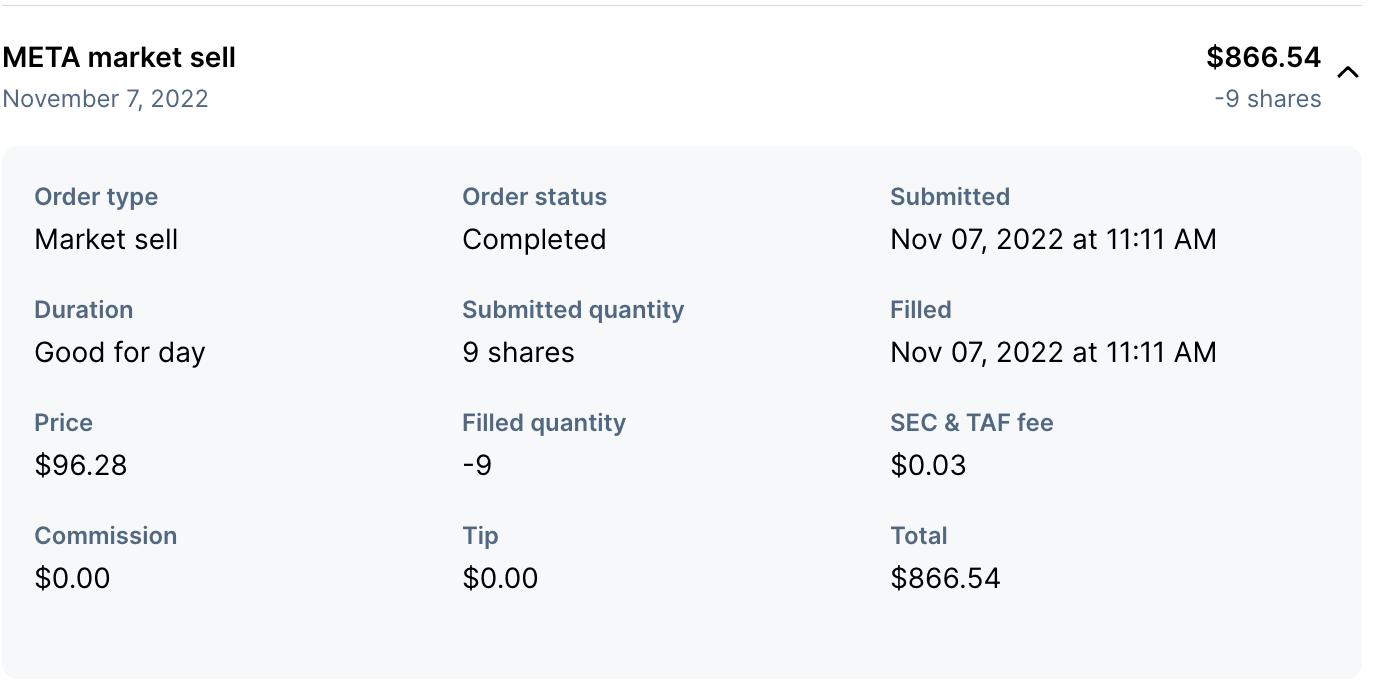

I was sitting on nine shares of Meta at rock-bottom prices and didn’t know it. I couldn’t wait to unload them. On Nov. 7, 2022, with the stock price finally above my average purchase price at $96.28, I did.

I made $2.41.

Meta’s stock price closed Wednesday at $439.19. On April 5, Meta’s stock closed at $527.34. I bought $5 worth of Meta stock again on March 6, 2023. Its share price was $184.89. My stake currently is valued at $11.94, a 138.32% unrealized return.

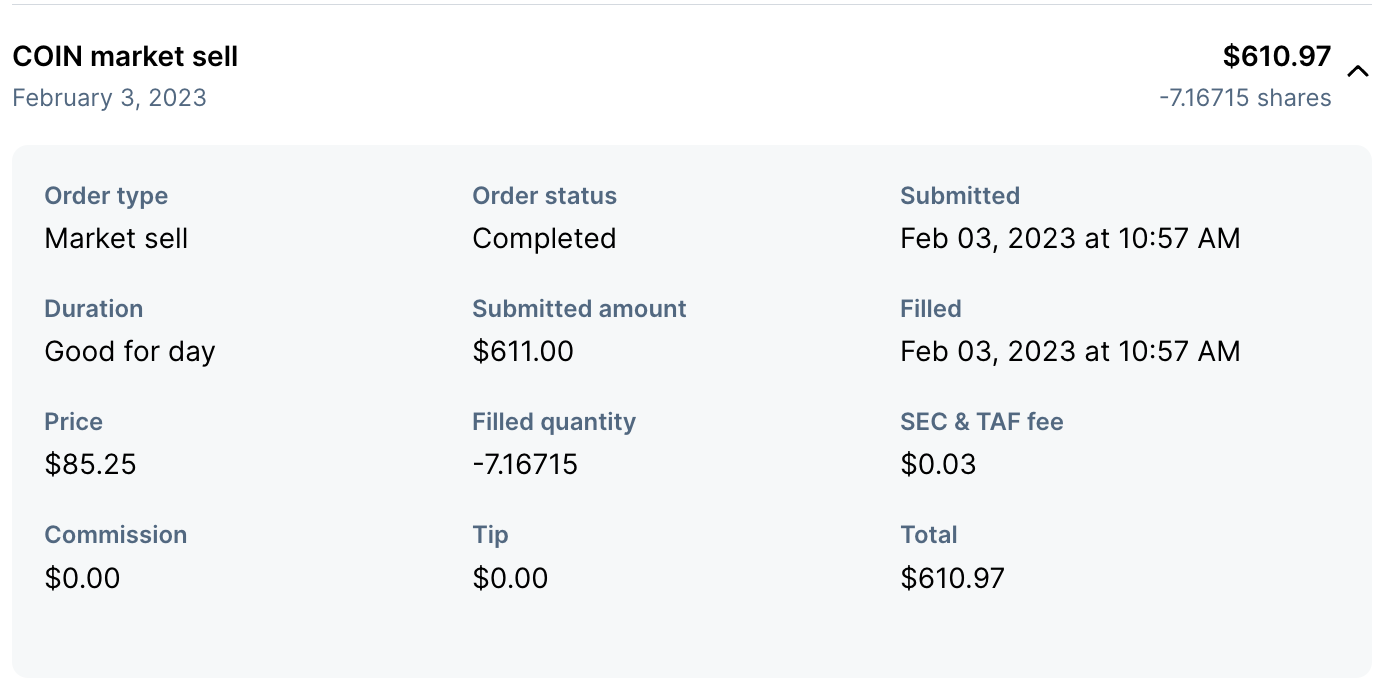

Missed profit: $3,086.19.Coinbase: From mid-November 2022 through early January 2023, I accumulated 17 shares of Coinbase. I still can’t intelligently explain to you what Coinbase is and does. But I made $319.25 selling 7.16715 shares of the company at $85.25 a share on Feb. 3, 2023.

Three weeks earlier, I had sold two shares at $43.15 a share for a measly $2.95 profit.

At Wednesday’s close, Coinbase’s share price was $210.09. In late March, the share price sat at $279.71.

I still have seven shares of Coinbase after selling a little more than three-quarters at $186.17 a share two days after Christmas. My average cost basis is $36.16.

My unrealized return is 492.9%, the largest in my portfolio. My gains could have been much bigger.

Missed profit: $894.75.Amazon: This one hurts because, more than almost any other company, I should have known not to be so shortsighted.

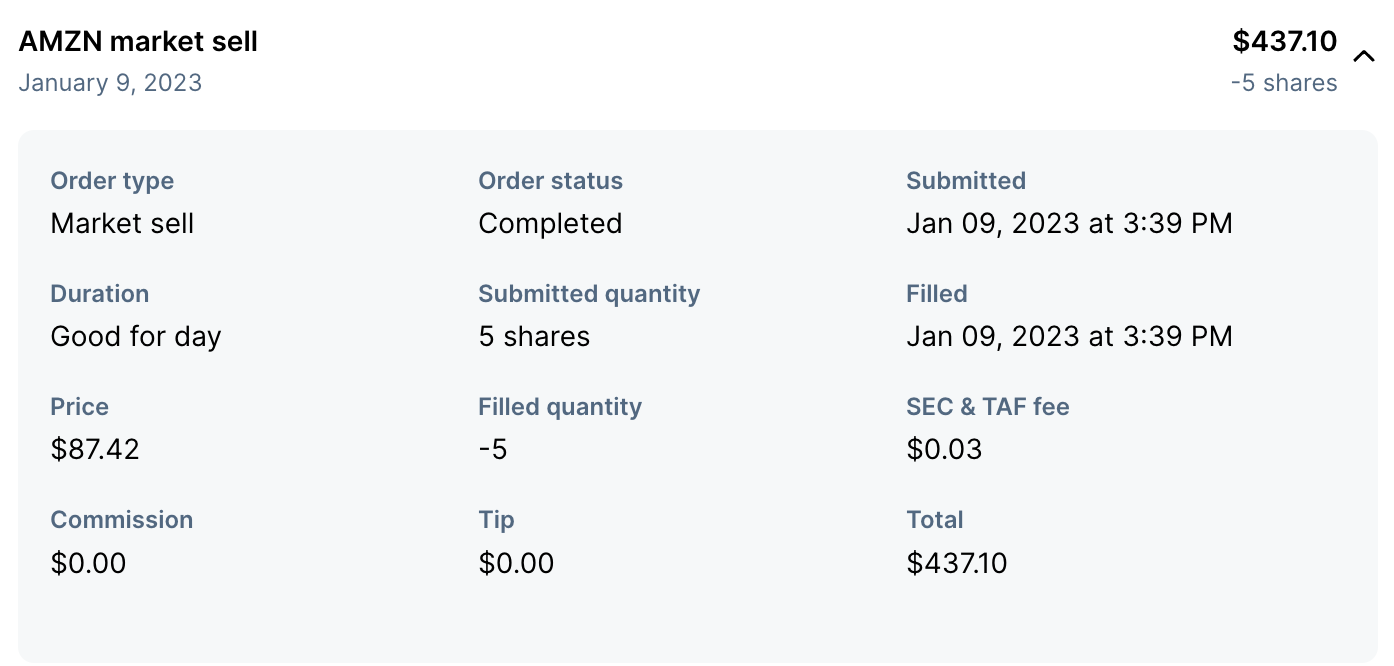

I gobbled up 25 shares of Amazon from December 2022 through January 2023. My purchase prices ranged between $81.80 and $88.80. I sold five shares at $87.42 a share on Jan. 9, 2023.

I made $3.29.

Amazon’s share price at Wednesday’s close: $179.

Amazon is one of the few individual stocks I wouldn’t mind holding for decades. My 20 remaining shares rival Coinbase as my biggest gainer. My unrealized return shows a 105.93% gain.

I’m not even counting the six shares I sold for $99.55 a share on Nov. 11, 2022.

Missed profit: $457.90.The Metals Company: I’m into this deep sea mining company for the long haul as a bet on the electric vehicle revolution. And I’ve turned a $422.06 profit selling four times. Ninety-seven percent of those gains came from my most recent sale, 500 shares in June 2023.

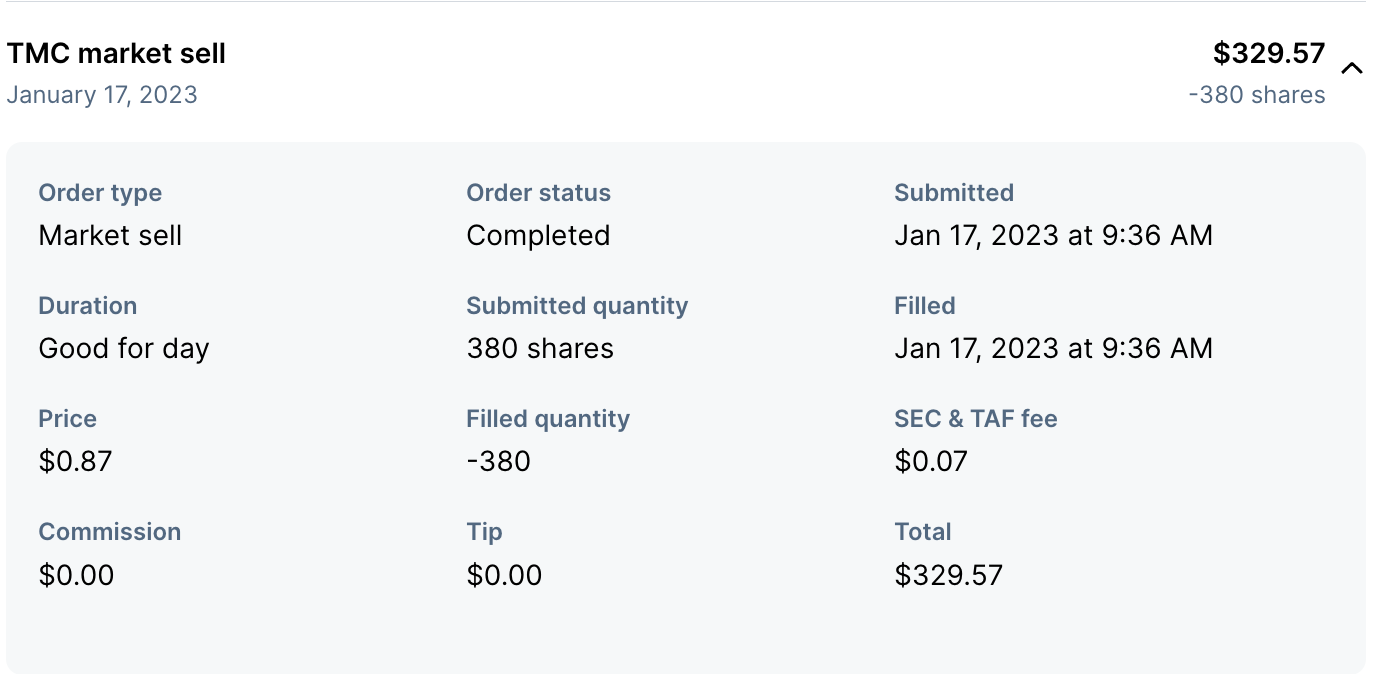

But my second-to-last sale, a 380-share stake on Jan. 17, 2023, was a mistake. I made $11.67 with the share price sitting at 87 cents.

The Metals Company’s stock closed Wednesday at $1.51. I still own 501 shares. But it’d be nice to have 881 at my average cost basis of 82 cents.

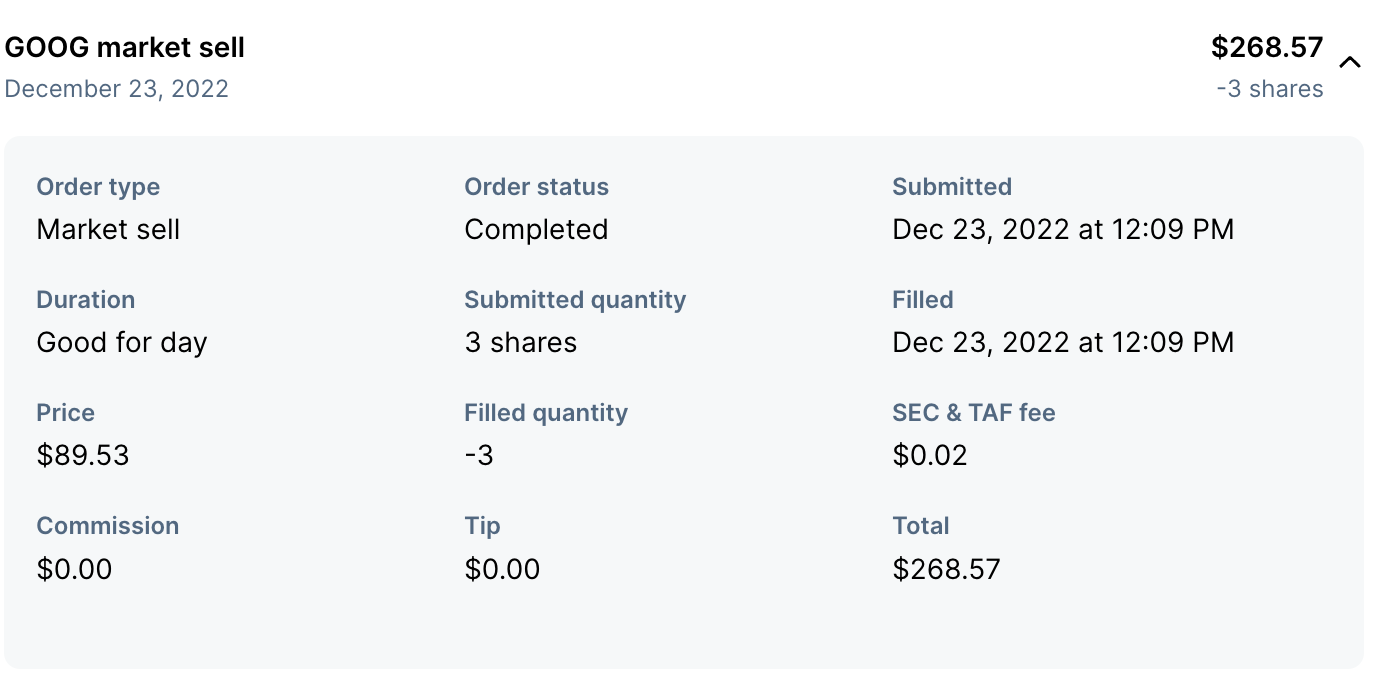

Missed profit: $243.20.Google: I sold three shares at $89.53 on Dec. 23, 2022. I can’t even remember why. But it wasn’t smart.

Google’s stock price closed at $165.57 on Wednesday.

I’m still holding four shares in my portfolio. As I see it, the only reason for me to sell would be to fold the money into my index fund and ride the wave there.

Missed profit: $228.12.Shake Shack: The delectable SmokeShack cheeseburger is all it took for me to become a believer in this fast casual chain. I’m buying the stock at a fair price and seeing what the future holds here.

But I sold four shares at $50.16 on Nov. 29, 2022 for reasons I don’t remember (notice a theme developing?). The stock price closed Wednesday at $103.33.

I started a new position on May 1, 2023, buying one share at $54.74. Because I still have a bad habit of trying to time the market, I waited until October of 2023 before purchasing a second share at $52.86. It helped my cost basis but hindered my growth. They’re my only two shares.

Shake Shack’s stock is up 85% over the past six months. I wish I still had my original four shares.

Missed profit: $212.68.Uber: On Dec. 1, 2022, I sold five shares at $29.

Uber closed Wednesday at $67.79.

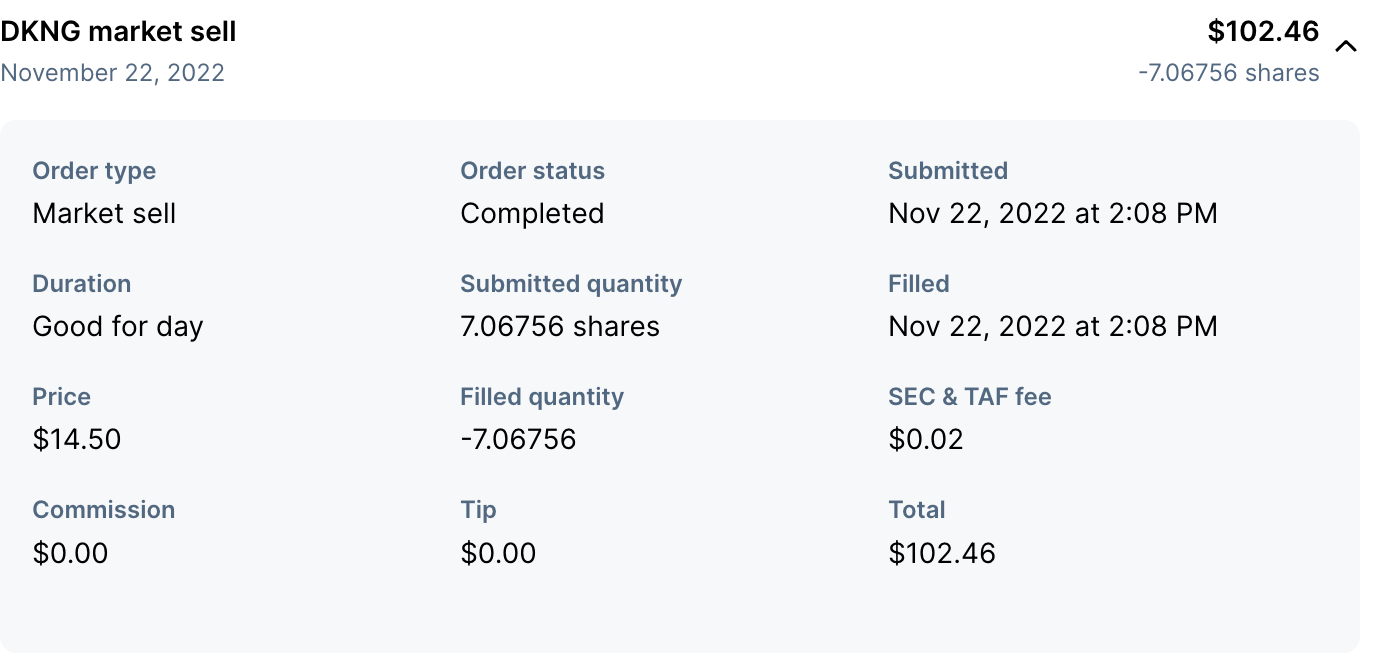

Missed profit: $193.95.DraftKings: Technically, I won my bet on this sports betting company. I made $11.79 selling a little more than seven shares on Nov. 22, 2022.

But I sold at $14.50 a share. The stock price closed Wednesday at $41.82.

Missed profit: $193.09.Shopify: Another company I wasn’t familiar with before making money off of it in the stock market, Shopify made me $5.57 on Oct. 20, 2022. I sold 4.78156 shares for $30.24 a share.

As of Wednesday’s close, Shopify’s stock price was $70.40.

Missed profit: $192.03.Advanced Micro Devices: I owned only two shares of this company and was too eager to take a $24.43 profit, selling my stake at $72.56 a share on Jan. 17, 2023.

Those same two shares closed at $144.27 on Wednesday. In March, the stock price topped $211.

Missed profit: $143.42.