I’ve added another smart money move to my routine.

When the calendar turns to August on Thursday, it will be my fourth straight month of following this basic strategy to grow rich.

Remember, though, I’ve elevated tithing as my chief financial task on the first morning of each month. After cheerfully fulfilling that duty, I’ll open my brokerage account and focus on my stock investments.

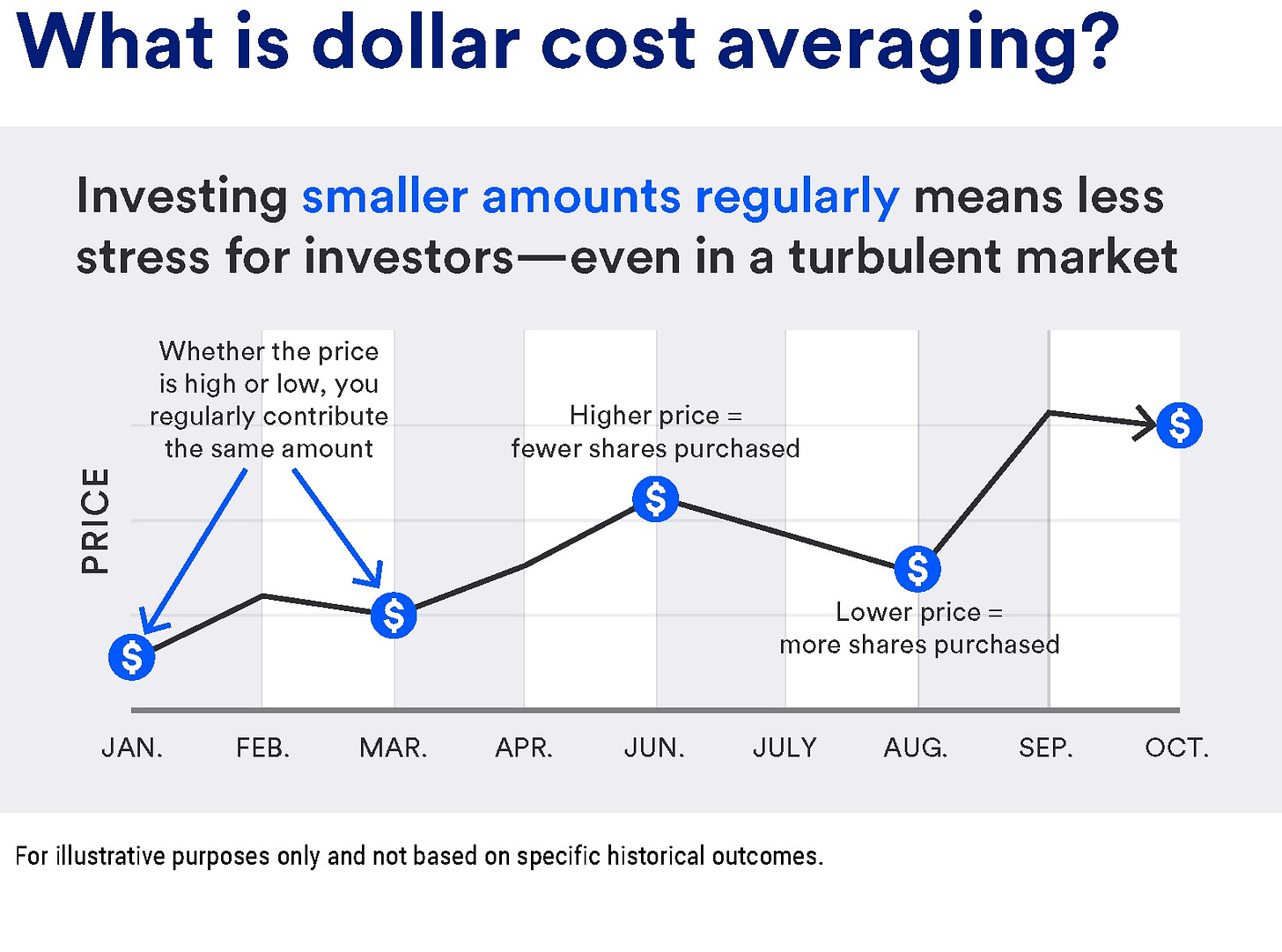

I’ve finally committed to dollar-cost averaging.

The method’s name sounds complicated. Following the practice is not. From start to finish, the process takes less than two minutes. And after time couples with the compound effect, it could change your family’s legacy for generations.

I mentioned my plan to dollar-cost average into my primary stock market exchange-traded fund (ETF) when I shared my money goals for 2024 at the start of the year.

It took the first five months of the year before I felt comfortable enough financially to consistently funnel money to a taxable account.

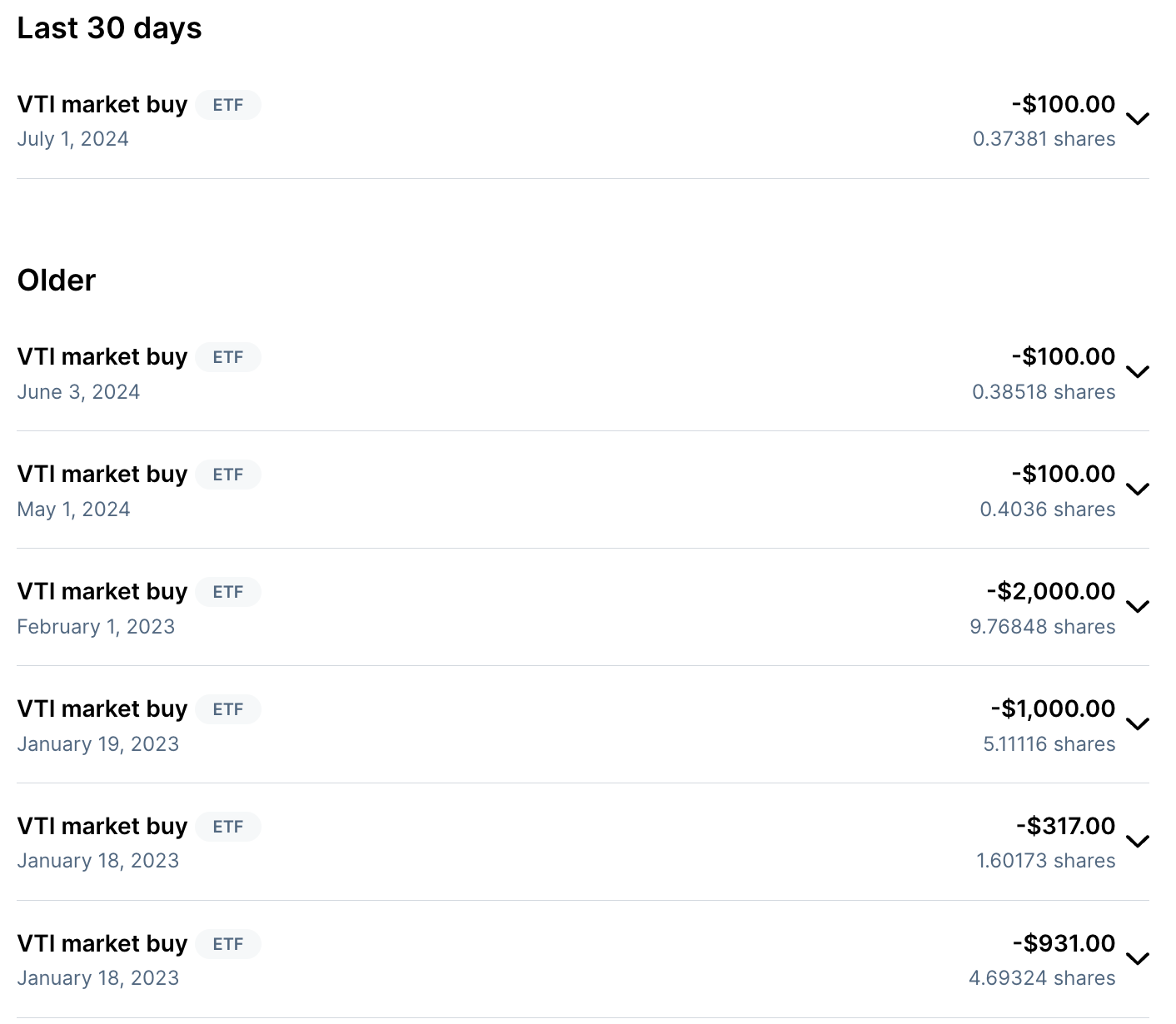

But it had been 15 months since I added to my stake in the Vanguard Total Stock Market Fund, ticker symbol VTI. I wasted time and watched opportunities slip waiting for a market correction.

When dips came, I didn’t have the funds to load up on shares. By then, expenses had piled or I hadn’t been disciplined enough with other investments to still be sitting on a wad of cash.

The result was that my stake barely budged.

Outside of collecting $159.03 in dividends over that span from the VTI, which automatically reinvested, my equity remained virtually the same as a year ago.

I’ve faithfully invested $336 each month into Parker’s taxable account for almost two years. Meanwhile I ignored the biggest position I’m building for my long-term brokerage.

On May 1, I changed that.

Since that day, I’ve directed $100 on the first of each month (or the first day of a new month that the market is open) to the VTI. It’s not much. But it’s what I can comfortably absorb after my money went missing this year. In time, I will increase my monthly contribution. But maximizing tax-advantaged accounts such as my 401(k), Roth IRA and HSA have surpassed my taxable account on my pecking order.

That’s all there is to dollar-cost averaging — investing a fixed amount on a scheduled loop.

This route stops me from trying to time the market. It guarantees that I make regular contributions. It eliminates my investing emotion and stress. It builds my equity little by little.

I might buy low one month and high the next. But unlike that 15-month span, at least I’ll be buying something.

I’ve added 1.16259 shares of the VTI by dollar-cost averaging a small amount over the past three months. My purchase prices each month reveal the importance of constantly buying.

In May, the stock price sat at $247.77 when I made my $100 investment.

In June, the stock price was $259.62 at the time of my order.

In July, the stock price reached $267.51 when I pressed the button.

Last Friday, the VTI closed at $269.69 and touched $270 after hours.

Had I waited until August to invest, I’d have been buying at peak prices. Dollar-cost averaging allowed me to add a little each month without ever worrying about the stock price.

I’ll do the same again Thursday, right after punching in my tithe.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.