I went on a selling spree in the stock market last month.

It was difficult. Because I know better than to sell prematurely. I’m already seeing profits I missed from positions I sold less than 30 days ago.

But I believe I made the right call.

I wasn’t going to grow rich by hanging onto a relatively minuscule number of shares in select companies. Our money will be put to better use elsewhere.

I also had been spending an inordinate amount of time watching the ticker, dutifully checking my portfolios during market hours. I learned a lot. But I freed myself from such fidelity. I took back my time.

I sold $4,211.90 worth of stocks, exiting five positions from Aug. 14-21. It was a continuation of my “everything must go” selloff from April. That round netted $6,224.56.

It’s all a part of my consolidation plans.

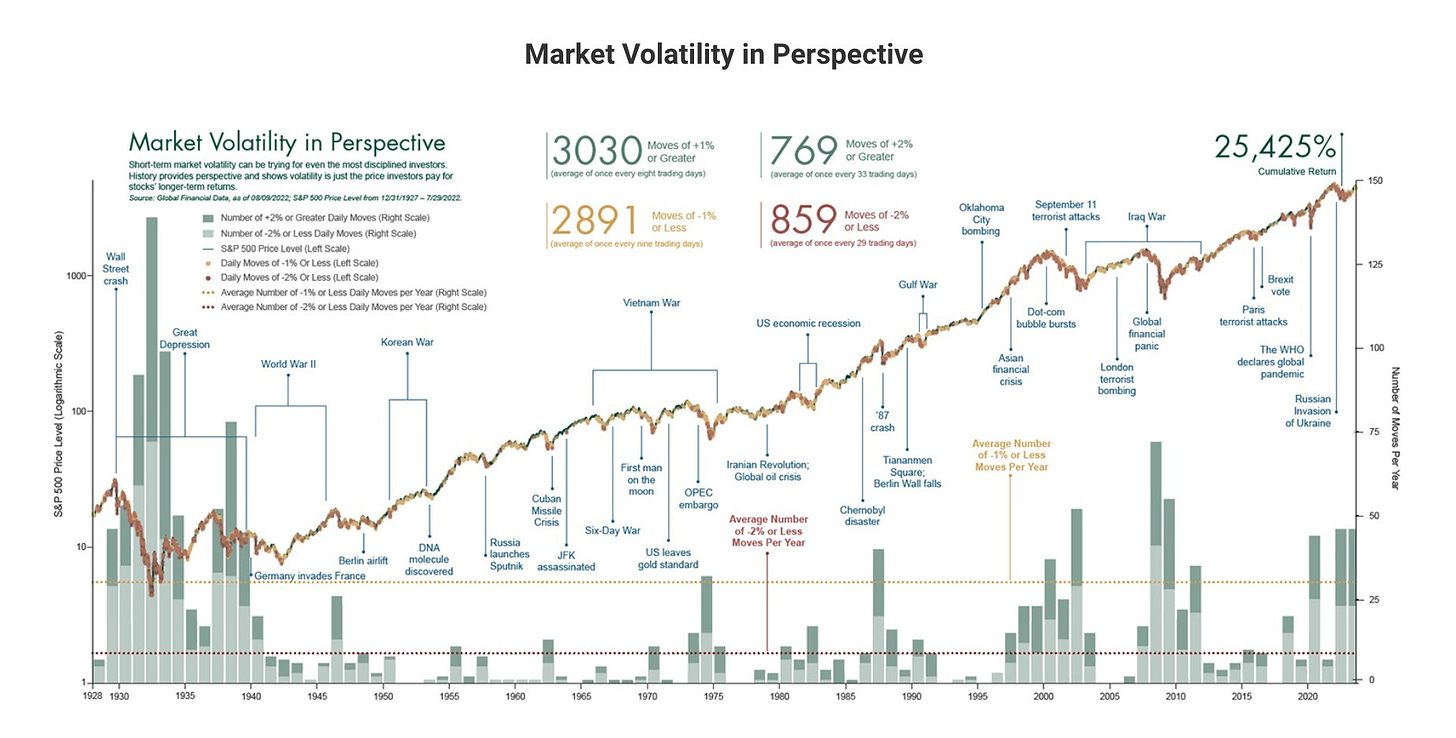

I’ve learned to trust index funds and ETFs that track the total stock market. They’ve proven to be safe vehicles for our money and profitable enough for me. They remove the angst that comes with the volatility of tracking individual companies, as well as the pain felt when said companies go red.

Unlike individual companies, we can be sure of the stock market recovering. It always does.

I sold the Vanguard Real Estate ETF, ticker symbol VNQ. I made a $214.93 profit from capital gains on the sale. But the stock is up $5.17 since I sold it on Aug. 21. I could have made an additional $122 by holding my 23.6 shares for another three weeks. Still, the VNQ was one of my best-performing dividend stocks. I also collected $132.96 in dividends from the stock since December 2022.

I sold Vornado Realty Trust, ticker symbol VNO. Like the VNQ, the VNO is a Real Estate Investment Trust (REIT). And that was another reason I sold — overlap. The Vanguard Real Estate ETF holds a small percentage of Vornado Realty Trust, as well as Realty Income, which I still own.

Meanwhile, my chosen total stock market fund, the Vanguard Total Stock Market Index Fund ETF, or VTI, holds them all.

A recent work trip to New York City nearly enticed me to keep VNO for a long time. I was walking to Madison Square Garden for a Knicks game, and when I arrived I spotted Vornado Realty Trust in construction directly across the street. I almost didn’t need to know anything else about the company.

A prime location like that was proof that my money was in the right place. But I didn’t care for the company reducing its dividend payout to once a year. I collected just $21.48 in dividends from VNO. But I profited $352.05 in capital gains on my 31.7 shares.

I also sold PayPal after riding out its recent slump. Like so many others, it was a company I once was really excited about investing in. Two years at this has taught me that’s a high that fades fast. I owned only 12 shares of PayPal and pulled in only a $10.99 profit. Hey, profit is profit! But there’s a better home for my almost $800 in principal.

Letting go of Shake Shack, on the other hand, wasn’t something I thought I’d do for at least 10 years. I believe strongly in the company, largely because of its product. Apparently the business is quite strong as well and growing.

I made $100.57 on only two shares of Shake Shack, doubling my investment. But its stock price has held strong, preventing me from buying more at a fair value. So I cashed out.

META, the parent company of Facebook and Instagram, was the fifth company I sold. This time, my stake in Meta was the definition of minuscule: 0.02708 shares. I paid $5 on March 6, 2023. I gained $9.18, including two cents in dividends, which bumped my lifetime gain from Meta to a whopping $11.59.

I’m still kicking myself for missing more than $3,000 on Meta by selling prematurely in November 2022.

That’s why each selloff feels strange. Worse than counterintuitive, they feel wrong. It’s always better to just buy and hold. But I had long-overdue cleaning to do in my portfolio.

So what will I do with the cash?

Instead of simply shifting last month’s haul into the VTI, I used a portion of the capital to put toward a few of my remaining individual companies like Hershey and Chesapeake Energy. I also maintained a portion so I could dollar-cost average into the VTI each month without worry.

But on Aug. 22, I transferred $2,500 to my options trading account. It was a milestone moment that showed how serious I am about playing this money game.

I told you about my interest in options trading last November. It’s a way for us to maximize our potential profits. Funding an account for the sole purpose of trading options was the first step. Twelve days later, I took the second.

On Sept. 3, I got some skin in the game.

I placed a $77.50 call option on Chesapeake Energy. The option doesn’t expire until April. For one contract — or the right to buy 100 shares — I paid $470.

I’ve been up $90 and down $130 over the first week. But I haven’t blinked. I’m building my tolerance. It’s all just numbers on a screen. Coming to that realization has helped evolve my understanding of money and how I operate it.

While wrestling with whether to sell my shares last month, I had to keep saying to myself, “my options account will thank me.” In time, I believe it will. Soon, I’ll look back on this August selloff simply as another smart money move.

At some point, I’ll sell the majority of my remaining individual companies such as Google, Starbucks, Realty Income Corporation and Chesapeake Energy. I’m currently fascinated by what the future holds for Starbucks under new CEO Brian Niccol. His arrival has enticed me to sit on my 32 shares, currently valued at a little more than $3,000, and wait.

I’m losing my love for Hershey, however, but I’ll continue to hold my small stake in the company. I’m also sticking with Nike and Amazon as leaders in their industries.

Oh yeah, I threw my first $100 on Bitcoin this week, with no plans to sell.

Then again, I’ve felt this high before.