I grew tired of my stringent new lifestyle twice in 2023.

Once in June. And again in early November.

In both instances, it would have been easy for me to break character. To backslide and revert to old habits. To allow a handful of poor decisions to jeopardize my extreme makeover that’s now 16 months in the making.

Back in mid-June, it was the dawn of summer that almost did me in. In early-November, it was my birthday. Abundant sunshine and my birthday, apparently, remain distractions for me. Cooking and eating at home instead of going out became a bit of a chore when the weather broke. My mood soured. In the fall, I wanted to turn a few bar visits into a few more. Fortunately, I resisted further damage. It would have blown my budget.

Both occasions brought a valuable lesson. They taught me the importance of endurance. Without it, this journey we’re on won’t amount to much. It’s the one thing that will make or break our march to financial freedom.

With the New Year underway, it’s important I remember those difficult periods and prepare for more that certainly will come in 2024. It’s imperative for me to fight back against temptation and to never give up.

I’ve evolved too much to turn back. Intentionality has filled my life with clarity, organization and healthy habits.

The majority of my spending is now routine. Most of my bills are on autopay. I’ve streamlined my everyday expenses, including groceries, gas and subscriptions. My saving and investing strategies soak up the bulk of my remaining purchasing power.

No longer must I deliberate over daily decisions, most of which are trivial when you really think about them.

To all you worrywarts, take it from me, life is better this way.

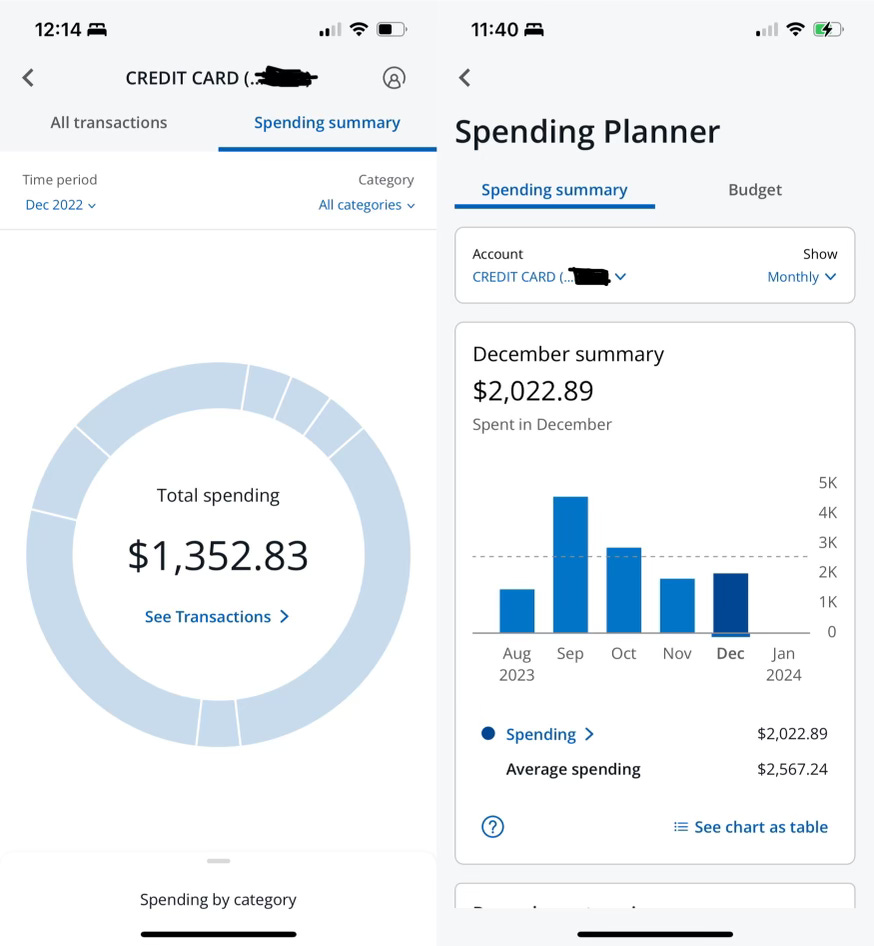

As for my December spending, something amazing happened. It speaks directly to the discipline and consistency I’ve developed since starting my transformation in earnest in September 2022.

My monthly spending from December 2022 and December 2023 was almost identical — if not for one purchase.

My credit card balance carries the majority of my purchases so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. But with the lion’s share of my expenses going on my credit card, it’s the best place to monitor my monthly spending. Each month, I have shared my progress, for better and worse.

There’s a tidy explanation for the $670.06 surplus in last month’s spending compared to December 2022. My daughter Parker’s iPad, the gift I gave her for her 10th birthday present, cost $676.31.

Take away the iPad, and the differential in my year-over-year spending in December 2022 and December 2023 was only $6.25.

I couldn’t believe it. Have I grown that rigid?

My spontaneous former self wouldn’t like the new me. But the old would respect the new. Sadly, I still have more hiccups than I care for, minor setbacks that mostly serve as annoyances.

I got hit with a $35 speeding ticket on a street I don’t remember driving. But the ticket came complete with photo evidence of my plates, captured from the street camera I clearly didn’t spot. I’ve got to pay $36 in court fees. And an unexpected $255.63 charge came from the attorney’s office I hired to form my LLC.

Beyond that, I closed out the year well. I know I’m on the right track.

Best money move: Trampoline park

With school out for winter break, I took Parker and her friend Tiffany to a trampoline park on Dec. 27. They got to run, jump, climb and play for 90 minutes. I declined their request for Icees, but only because of the sugar, not because of money. Although their playtime cost $52.81, which seems pricey. But they had fun, and that’s what matters most to me.

Worst money move: The Wall Street Journal

Once again, I wasn’t diligent and allowed a subscription to auto-renew. This one crept in as my second-to-last purchase in 2023, an unexpected $38.99 monthly charge. I immediately canceled. I had been enjoying a sweet deal at $4 a month from last January through November 2023, paying $48 total for the year (excluding the $38.99) after two charges in November. The Wall Street Journal is a valuable publication given my new interests in business and personal finance. I’ll be back. But only when the company offers another sweetheart deal.

Can’t get enough Money Talks?

Darnell, well done on catching a subscription fee (I need to do the same, but have been lazy). You are "directionally accurate" as Brad Barrett from the ChooseFi podcast says often in your game plan and that's whats important!

And yes, the trampoline park is a big W for getting the kiddos out and expending energy 😉