The best advice I received about investing (and how it changed my financial future)

The game-changing guidance that turned my finances around — fast.

What’s the best financial advice I’ve ever received?

“Do not pay for anyone’s service,” my guy Brandon texted me on Oct. 8, 2022. “Plenty of free info out there to learn from.”

I was only 10 days into my new love affair with the stock market.

Twenty-five months later, I understand. Anyone who truly wants to change their life financially can easily learn the basics of stock investing via YouTube, podcasts and books. My commitment to educating myself has been the foundation for my personal and financial transformation.

I’m smarter with money and have become pretty good at growing our resources. I’m no longer a novice at this game, but I still have more to learn. And a pipeline to good knowledge is always worth paying for.

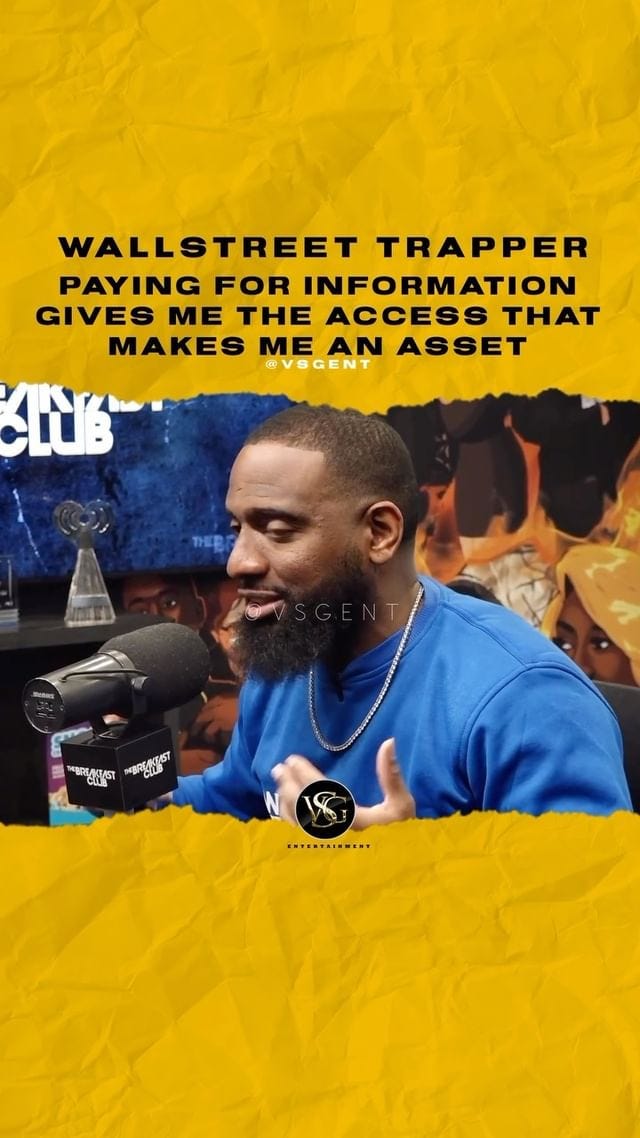

One of my many money mentors, Wallstreet Trapper, hammers that point. It’s one we all should abide by when deciding how to dole out our dollars.

“I always say three things we’re supposed to spend our money on, one is information, one is access and the other one is assets,” Trap said during an interview with The Breakfast Club.

“I’m OK with paying for information. I’m OK with paying for access because I become the asset. If I become the asset, nobody can take that away from me.”

Last Friday, I took another step toward becoming a bigger asset.

It all started after I made my first winning day trade.

I earned a $32.68 profit in just 62 minutes — a 30% gain on my invested capital. It was 10:15 a.m. when I sold, and I had achieved my goal for the day.

Driving back home from dropping off Parker at school, I said to myself, ‘I want to make some money in the market today.’ But I wanted a realized gain, or money I could pocket immediately, not just an increase in my account’s value, or an unrealized gain.

I can’t take the credit.

Within 10 minutes of walking into the house, I pulled up X (formerly Twitter). I spotted a free stock tip from one of the many experienced traders I follow.

I did my own quick research on the company, Hims & Hers Health, Inc., ticker symbol HIMS, and jumped in. The company’s stock price dropped more than 7% on Friday morning, aligning with a strategy I’m comfortable with, which is buying dips.

Stock options are different, though. Fast money also carries the potential for swift losses. So I’m careful.

My HIMS contract didn’t expire until this Friday, but I decided to lock in my profits before anything unexpected could happen. It takes time to build tolerance for this game.

It also takes discipline not to be greedy.

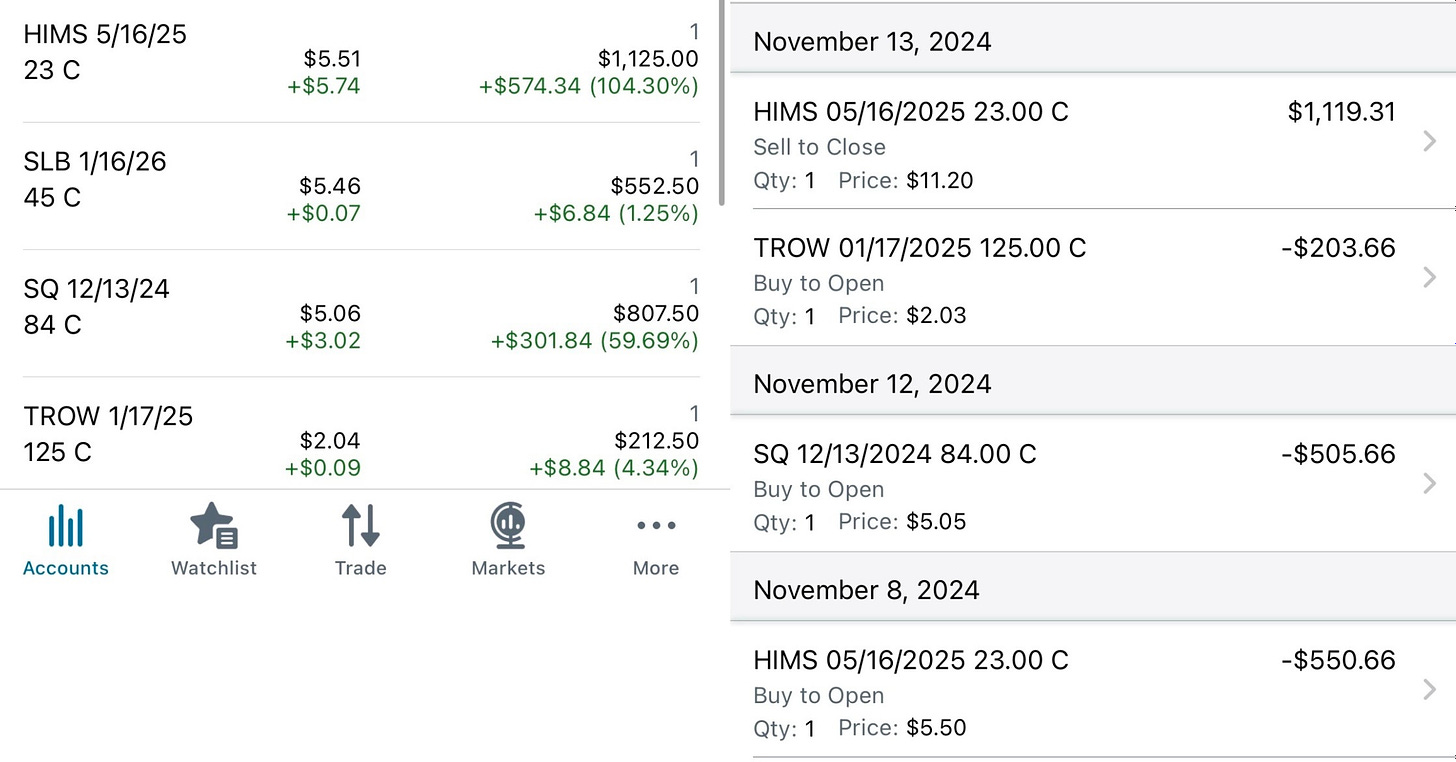

Feeling confident after my initial success, I decided to dive deeper into the market. By noon last Friday, I had jumped into another HIMS trade. This time, I bought a $23 call option with a May 16, 2025 expiration. That means I anticipated the stock price would rise. And this time, I risked five times the capital. The original stock picker who provided the tip, @BullTradeFinder on X, sold me with his conviction in the company.

My second HIMS contract cost $550.66.

I know what you’re thinking. Like I said, you’ll need the right temperament for stock options.

But are you ready to hear the upside?

I sold my second HIMS contract on Wednesday morning for $1,119.31 — a 103% profit. I pocketed $568.65. It was 8:50 a.m. The stock market had been open for only 20 minutes.

I held the options contract for just three trading days.

It was a classic example of the No. 1 investment rule: “buy low, sell high.”

At market close on Monday, my unrealized gain showed $399.34, a 57% potential profit. But apparently I grew enough fortitude over the weekend to keep letting it ride.

On Monday night, I messaged @BullTradeFinder to tell him that he’d help me grow my account $431 in two trading days. With four screenshots, I showed him my HIMS contract, my unrealized gains, my completed purchase into his trading community and my confirmation email.

I still don’t know the man’s name.

Sounds crazy, right? But I understand the risks. I’m only investing money I don’t need to live on. The amount I’ve dedicated to options trading also is a tiny percentage of my investment portfolio. I started with a little more than $2,500. My first goal is to grow it to $10,000.

In four trading days, @BullTradeFinder helped us earn $601.33. All I had to do was pay attention and push a few buttons.

It doesn’t take a mathematician to recognize the value in that.

Yet the old me would have balked at @BullTradeFinder’s fee. He offers three monthly tiers: $99, $69 and $39. I would have thought it was a scam, and I’d be $601.33 poorer now.

After seeing HIMS’ stock skyrocket 23% Monday, along with Palantir, another one of his picks, rising 9% on the same day, @BullTradeFinder tossed his followers another favor. He discounted his monthly membership by 29%.

Suddenly his second tier cost just $48.99 per month.

Again, I nearly made that in 62 minutes thanks to @BullTradeFinder. I’m still learning how options work. The membership easily pays for itself.

It’s given me access to educational material, live trading, real-time stock picks (with charts and explanations), and a supportive community of fellow traders. Dozens of stock picks are signaled each day. Many are profitable.

For now, I’m selling my winners at 100%. I’m learning to live with whatever happens next. We would have doubled our money, and taking profit is the point. There will always be another trade to enter. But greed can wipe out your gains.

I had to navigate those emotions Wednesday. And I don’t envision them going away anytime soon.

But thanks to @BullTradeFinder, a man I’ve never met and whose real name I still don’t know, I’ve found the right community for me.

With it, we will now earn while we learn.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

I LOVE Wallstreet Trapper! I opened a brokerage account this month and last Friday invested some money into a money market.

And I had a day trade lesson…I’m looking to invest in AXON for a few reasons but there’s somethings I was advised to look at first.

I’ll be 34 in a week and reading about your success with something another Black man has been talking to me about for years pushed me into the leap. I’m saving this to read again with my study cap on to really understand but I wanted to comment to let you know you are inspiring!

The discipline is what it really takes beside the temperament.

If you can handle the stop-loss on those days that don't work, you are probably fine.

Big picture it is pretty scary that we had almost only bull runs the last decade, so a prolonged down-turn is unknown to most newbies.