I earned $113.30 in dividends from my taxable brokerage account this cycle.

I’m disappointed. My dividend payouts are dwindling, and I don’t like it.

But that tells you how far we’ve come in our investing journey.

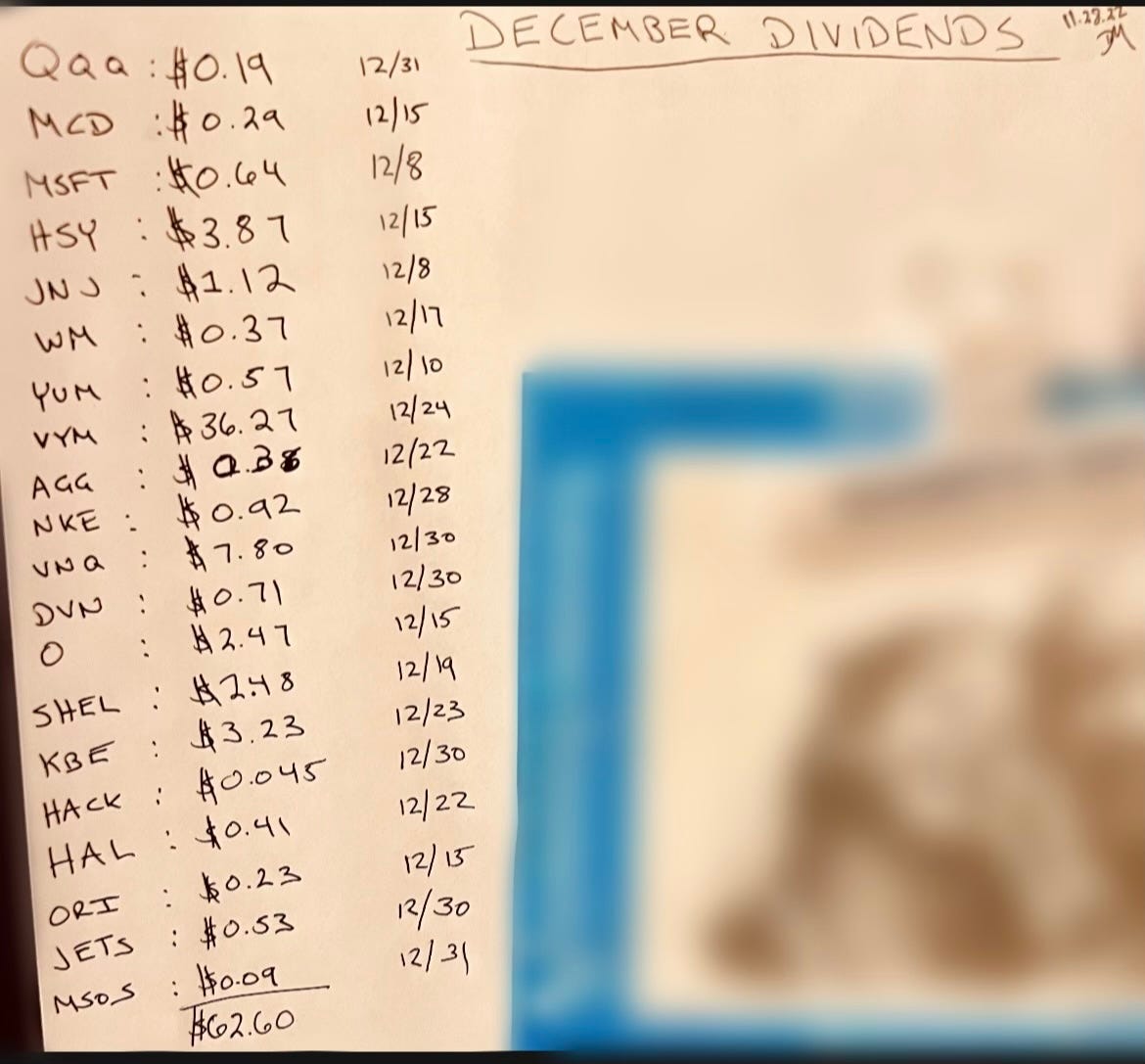

Less than two years ago, I dutifully tracked every penny we earned in dividends. I still do. Only then, I wrote each deposit on a blank sheet of printing paper that I proudly pinned to our refrigerator. I still have the December 2022 sheet of paper that shows we pulled in $62.60 in dividends from 20 companies that month.

Since then, much has changed with both my portfolio and my investment strategy.

After playing around in the stock market for two years, I’ve finally trimmed my portfolio to a dozen stocks. Seven pay dividends. The move has simplified my investing but destroyed my anticipation for hauling in a lot of dividends.

Gone are the days when I held more than 50 companies, hoping to eat off every dividend payout possible. I started consolidating last year. In August, I dumped more dividend-paying companies.

My remaining seven dividend payers are made up of the Vanguard Total Stock Market Index Fund ETF (VTI), Hershey, Nike, Starbucks, Realty Income, Expand Energy and Google.

Of those seven, only three remain in my long-term plans: VTI, Hershey and Nike.

I’ll sell Google when my four shares climb back to a 100% gain. I’m currently sitting on an 84% unrealized gain, or $309.39. I’ve made enough of a profit. I can put the money to better use elsewhere.

The same is true for Realty Income (O), which I’ve planned to sell since the start of the year. I have $1,200 invested in “The Monthly Dividend Company,” but not even its monthly payout is worth my cash. After 690 days with Realty Income, my unrealized return shows 5.15%, or $62.34. I’ve received 22 dividend payouts totalling $89.24. I’ve learned that we can do much better with our money.

I’ll retain Expand Energy (formerly Chesapeake Energy) and Starbucks a little longer before saying goodbye. I bought shares in both at dips this year. And I like the trajectory of both companies, Expand because of its recent merger and Starbucks because of its new CEO.

Starbucks, as expected, pushed me beyond $1,000 in lifetime dividends inside of my taxable account after receiving an $18.57 dividend from the coffee giant on Aug. 30. I’ve held a position in Starbucks since May 2023, and my stake is currently up 25%. If Brian Niccol, the new CEO, has the same impact at Starbucks as he did at Chipotle, I want to be along for the ride.

But I’m done chasing dividends. I’ve found something significantly better.

Yet after the latest batch, my taxable account has earned $1,110.49 in dividends. I’ll continue dollar-cost averaging into the VTI and allowing it to provide the bulk of my dividends. But last month brought a $16.43 payment from Hershey and a $12.61 payment from Nike as well. I still love seeing dividends land from those two companies.

My daughter Parker, meanwhile, has collected $651.26 in dividends within her Uniform Transfers to Minor Account (UTMA). Her position in the Vanguard High-Dividend Yield ETF (VYM) paid her a $113.21 dividend on Sept. 24.

One day later, Parker received her second dividend payment within her Roth IRA, a $22.33 deposit. She’s up to $46.93 in dividends in that account.

My Roth IRA is growing rapidly too. In addition to crossing the $25,000 mark in unrealized gains last month, I’ve earned $2,587.31 in dividends since opening the account in December 2022.

So make no mistake, I’ll still happily collect dividends.

But my relationship to dividends has changed as my investment strategy has evolved. Consistently sharing in companies’ profits once was the carrot that enticed me to become a better steward of my money.

Dividends fueled me to deploy my discretionary capital differently, to make smarter choices with my money so that I’ll routinely receive value in return.

And we’ve done well.

Now it’s time we learn to maximize our returns.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.